Philip Settimi

MSE MD, President and Chief Executive at PartsSourceIntroduction:

Hospital systems are under intense pressure to optimize their resources and multiple challenges make intelligent spending imperative. In this installment of PartsSource’s “How Healthcare Systems Can Save Millions” blog series, PartsSource CEO and President Philip Settimi, MSE MD dives into the biggest challenges healthcare organizations face in spending and the hidden, strategic opportunities to drive costs down.

Challenges:

Operating margins are down, labor costs are up and climbing, and everything from supplies to the cost of capital is rising with inflation. These are just some of the issues that many healthcare systems are facing, making it more important than ever to optimize resources and spend strategically. But what are the obstacles causing the most difficulties? The following are what we consider to be the most significant challenges for hospitals:

Declining Margins

According to the KaufmanHall National Hospital Flash Report, the median operating margin among hospitals and health systems was -1.1% in February 2023. Though median margins are higher than 2022, they are still down 35% compared to February of 2020. Returns on non-operating assets also continue to be erratic. This means that providers cannot depend on investment income to make up operating shortfalls, a situation that is clearly unsustainable.

Increasing Workforce Expenses

While the U.S. Bureau of Labor Statistics shows that the total healthcare labor force has finally returned to its pre-pandemic level, unemployment rate for hospital workers is a mere 1.5%. This puts upward pressure on wages and per-patient expenses, which, according to KaufmanHall, soared more than a third between 2019 and 2022. The shortage is only expected to intensify as the training pipeline fails to meet the need to fill increasing job openings from healthcare workers leaving the field by means of retirement and changing fields.

Additionally, higher labor costs also impact other expense categories. These include service contracts and third-party labor.

Overall Inflation

In 2022, inflation spiked, affecting every aspect of hospital budgets. And, while Reuters shows that the year over year CPI increase of 9.1% is the highest it has been since 1981, some expense categories have been hit harder. For instance, the AHA says supply costs were up more than 20% by 2022 compared to a 2019 baseline, and certain categories jumped even more, like ICU supplies (nearly 32%) and respiratory care supplies (nearly 26%). Lastly, the cost of borrowing also fluctuates with interest rates, making the total cost of capital investments more unpredictable than it has been for years.

Opportunities:

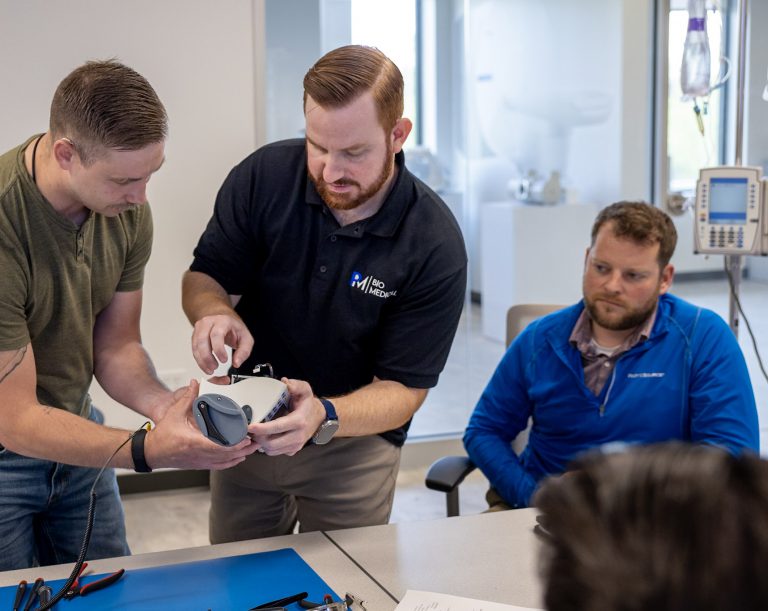

Despite these pressures, we still see significant opportunity for every hospital and healthcare system to drive costs down and margins up. How? The answer is in an area that is frequently overlooked: the management of medical equipment.

Medical equipment management encompasses everything from million-dollar equipment to bedside devices that represent a modest dollar investment. Both can make a life-or-death difference to a patient.

Hidden Strategic Opportunity

For all these resources, whether it is an MRI machine or an infusion pump, uptime is crucial. Even one minor malfunction can represent thousands in lost revenue. For example, according to the Journal of Orthopaedic Business, when an operating table’s lift is broken and an OR must be taken out of service, the lost time costs an average of $46 per minute. That is $4,600 per hour depending on the type of procedure being delayed.

Another recent study published by the Sociedad Beneficente Israelita Brasileira Albert Einstein, showed that surgical procedures last an average of 130 minutes (about 2 hours), meaning that each lost procedure represents an average of $6,000 in lost revenue. The cost of waiting for the repair dwarfs the cost of the repair itself, not to mention the immeasurable negative impact of frustrating your surgeons.

Every organization’s leadership understands how equipment downtime can reduce quality of care and the satisfaction of both patients and clinical staff.

Management of Medical Equipment

Healthcare providers have a spectrum of options for managing medical equipment. The two ends of the spectrum include outsourced and insourced.

For context, outsourced is when external labor is used to manage replacement parts procurement and equipment repairs. Insourced is when the internal staff provides equipment service, manages replacement parts procurement and service contracts established with equipment manufacturers.

Overall, every organization uses some hybrid of these two approaches. However, many make these choices reactively rather than strategically. The provider rarely has any insight into its genuine cost of service in either case. This is because contractors have no incentive to provide such insight, and in-house staff do not have the bandwidth or expertise to create systems to track and analyze it. As a result, they may not know if there are better options available to them. For instance, is the premium they are paying on a manufacturer’s service contract justified by faster, better service that decreases downtime? Is the manufacturer even living up to the performance commitments in its contract?

By routinely reviewing and analyzing their approach to medical equipment management (no matter what approach currently in use), hospitals and health systems can remove costs from their supply chain with no impact – or even positive impact – on service levels and quality of care. We estimate the value to the nation’s opportunity, to the nation’s healthcare system as a whole, at more than $2 billion per year.

Data is Key

What is the secret to this cost savings opportunity? The answer is data. According to our research of more than 100 surveyed hospitals, hospitals are used to benchmarking and tracking so many aspects of their operations, but fewer than 10% of them actually monitor the performance of their service contracts to see if they are getting good value for what they are spending. Similarly, they are in the dark about their spending on replacement parts. Shining a light on these areas can reveal ways to save millions by bringing the provider’s performance in line with national best practices.

Regardless of the specific composition of a hospital’s medical equipment management program, a clinical resource management platform that streamlines the procurement process and provides visibility to strategic analytics can help teams operate more efficiently and effectively, while providing the organization’s leadership with accurate data to understand the value of the program.

Conclusion:

Despite the challenges, there are many opportunities for healthcare organizations to save, especially in equipment management. In the next installment of the series, PartsSource’s Senior Vice President, and Chief Revenue Officer Joseph Zaluzney will dive into what strategies hospital systems can implement to address these challenges and seize the opportunities previously discussed.

To learn more about how PartsSource can help your organization start your cost savings journey, learn more about our PartsSource Repair and Service Agreements solution here.