Jason Behm

Vice President, Contract Solutions & ServicesIntroduction

According to a recent analysis of more than 600 U.S. health systems, there is a risk of average healthcare operating margins falling from 5.4% in 2022 to -15% in 2027. Quality patient care is the cornerstone of every hospital’s mission, but systems cannot continue to deliver outstanding outcomes without addressing the financial realities through sustainable, evidence-based strategies.

Service and equipment service contracts account for $10 billion in the U.S. healthcare system-a significant opportunity for healthcare leaders to take cost out. So why are many systems still overpaying for full-service contracts when they could be optimizing their in-house capabilities, maximizing quality/clinical asset availability and driving efficiency across the equipment service supply chain?

In 2014, PartsSource revolutionized parts procurement by introducing PartsSource PRO®, a technology-enabled, evidence-based platform purpose-built to solve for issues identified and validated through an in-depth analysis of parts procurement across U.S. healthcare providers. In 2022, a similar longitudinal analysis was published for service contracts. The methodology utilized proprietary data analysis, primary research, and assessments of over 500,000 service contracts to validate hypotheses and identify best practices.

At a high level, this study identified four common pain points in traditional medical equipment service contract management that contribute to the urgent need for a new approach to service contracting. These are contract management complexity, clinical risk alignment, vendor performance monitoring, and contract cost variance; when systems overcome these challenges, they improve financial, clinical, and operational performance.

Reduce the Complexity of Contract Management

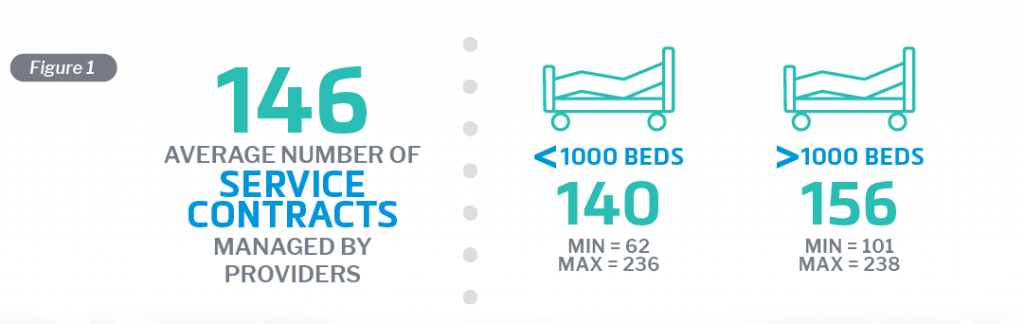

An average hospital manages 146 equipment contracts (see figure 1). That translates to ongoing uncertainty across dozens of contracts and vendors around whether value is commensurate with cost, whether contract type is aligned with clinical risk, and whether the cost is in line with benchmarks. Compounding the complexity is the sheer volume of contracts, multiple renewal dates, the wide variations in contract types, and the unique terms in each contract.

However, leading systems overcome these challenges by rationalizing traditional service contracts into a single agreement through a nationally benchmarked evaluation to reduce not only the cost but also the complexity and administrative burden of managing multiple vendors, renewal dates and contracts, allowing HTM and supply chain leaders to focus on more strategic tasks.

Align Clinical Risk and Service Strategy

Another finding from the research was that across systems, there were few modalities where a particular service strategy was prevalent, e.g., most systems cover Lab Analyzers with full-service OEM contracts, presumably for peace of mind with mission-critical equipment. However, for the most part, there is little correlation between contract strategy and risk profiles for different equipment types, which can result in inefficiencies and unnecessary costs (see figure 2).

The research recommends that service contract strategies should be based on data and align contract approaches with actual clinical, financial, and operational risks. With a data-driven approach to risk assessment, providers can make more informed decisions about which contracts to prioritize and how to manage them effectively.

Realize Value for Your Service Contract Dollar

Understanding whether you are receiving what you pay for is important for all of us in our own daily lives. When it comes to contract management, though, the research found that 92% of hospitals do not have a system or processes to regularly monitor service contract compliance (see figure 3). This lack of monitoring can lead to diminished clinical availability and increased costs.

To address this issue, a solution would need to measure and report Key Performance Indicators (KPIs) on factors such as service response time, service quality, and service cost. Active and consistent monitoring of these KPIs can ensure that vendors are meeting their contractual obligations and that providers are getting the best value from their contracts.

Address Contract Cost Variability

The study’s analysis also revealed a significant issue with contract cost variance. In one example, a 57% range between min and max cost was found for full-service contract costs on the identical asset, an OEC 9900 C-Arm common in U.S. hospitals (see figure 4). This variance can lead to healthcare providers overpaying for services and struggling to negotiate effectively with vendors.

To overcome cost variance, providers should benchmark their service contract costs against peers using third-party data. By comparing their costs with industry averages, providers can gain a clearer understanding of the market rates, leading to a more balanced negotiation with vendors and ensuring they are not overpaying for services.

Unlock Substantial Savings While Improving Quality

In the pursuit of substantial cost reductions within annual budgets, forward-thinking healthcare systems can leverage data-driven service contract management. By adopting best practices to navigate the challenges associated with conventional service contracts, organizations can implement strategic approaches that not only generate sustainable cost savings but also enhance quality and clinical availability. Learn more about the best practices outlined in this article in this white paper and revolutionize your approach to achieving significant savings without compromising on quality.